Why Caesars is extremely attractive at this price point

Can the stock double in the next few years?

So far this year Caesars share price has declined substantially despite operating performance holding up fairly well. Recently Carl Icahn has taken a position and as the company completes its debt reduction, shareholders should be positioned to receive high returns, both in the form of share buybacks, earnings growth, and multiple expansions as the digital segment continues to grow.

History

Although the company is called Caesars it is the successor of Eldorado Resorts. Eldorado Resorts was founded in 1973 by Don Carano and other members of the Carano family. The company began on a path of building and acquiring a variety of casinos in the US, operating exclusively in Reno until 2005 when they started to acquire regional casinos as well. The company went public in 2014 through a takeover of the public company MTR Gaming. Since going public they have engaged in substantial M&A first through the acquisition of Isle of Capri. After divestitures of certain assets, this brought the number of Casinos owned by Eldorado from 7 to 19. These are all regional casinos some with hotels as well. Then in 2018, the company added 7 additional properties through their acquisition of Tropicana Resorts. These acquisitions were all highly value accretive as Eldorado managed to aggressively cut costs without having too much of an impact on revenue. They cut things like free buffets, free food, and other industry fixtures that were often done because of tradition rather than any data showing they provided a good ROI. They also cut out layers of mid-management and had casino managers report right to their small executive team. The transactions were highly levered through debt and some sales-leasebacks so the bump in earnings was tremendously accretive to the bottom line. In 2019 before their Caesars transaction, they had casinos in a variety of states but their only exposure to Nevada was in Reno. This left a hole in the portfolio as it would be beneficial to have a Vegas casino that they could funnel their regional guests to. Eldorado did have Reno and Atlantic City exposure which are both considered destination markets but they pale in size compared to Vegas. At the same time, management wasn’t going to rush into Vegas and buy the first resort to hit the market. They knew that the one resort they owned would not serve all their regional customers well as it could be too low-end for some and too high-end for others. As a result, they waited but eventually, Caesars hit the market.

Around this time Caesars Entertainment was transforming as well. In 2005 another casino company Harrahs acquired Caesars for $10 billion in response to the consolidation of MGM, Mirage, and Mandalay. Harrahs had executed well in the few previous years as their CEO Gary Loveman had made significant investments into the Harrahs loyalty program. This program availed of data analytics and was the first to track spend and allow reward redemptions across all of their properties. After the merger, the combined company owned 55 casinos, including 7 on the strip, and eventually, they changed their name to Caesars from Harrahs. Then in 2008, the company was taken private by Apollo and TPG for $33B. The deal was highly levered and was made right before the GFC leaving them in peril. The GFC hit Vegas particularly hard as in addition to demand dropping new supply was coming online thanks to the large appetite for real estate-backed securities. Eventually, in 2015 the company filed for bankruptcy and there was a messy fight between creditors as detailed in the book The Caesars Palace Coup. This ended in 2017 when the company was split into an operating company and a REIT that owned all the real estate. Then in 2019 Carl Icahn, who owned a large equity stake, pushed Caesars to find a merger saying

I believe the best path forward for Caesars requires a thorough strategic process to sell or merge the company to further develop its already strong regional presence, which will allow Caesars to continue to take advantage of the Caesars Rewards program bringing more and more players into Caesars' Vegas market

In 2019 Eldorado acquired Caesars paying $7.2B in cash and giving Caesars shareholders just under half the equity in the new company.

Command of the combined company was given to Tom Reeg who has been CEO at Eldorado since 2018 and before that, CFO since before Eldorado went public. Upon the merger closing the company changed its name to Caesars. The Eldorado management had a strong record with the share price going from $9.70 upon going public in 2015 to around $60 at the end of 2019 representing a CAGR of over 29%. The problem was that the deal closed right before covid and given that it was heavily financed with debt this put Caesars in a difficult position and delayed the timeline for the debt paydown. Eldorado did have a chance to back out of the deal thanks to a material adverse event clause, however, they decided to push forward with the deal seeing how well the assets complimented each other. In acquiring Caesars, Eldorado got exposure to Vegas in all price categories, got a presence in nearly all the gambling states, inherited a better loyalty program, and a better brand. They estimated synergies of $500M a year and have since realized this target.

Balance Sheet

The company runs a highly leveraged balance sheet and a lot of the decline over the past year can likely be explained by aversion to this, as well as concern about how the company will fair in a weakened consumer environment.

Leases are not equivalent to debt

The market is likely viewing Caesars debt as being higher than it is due to the lease liabilities being included in the debt. I believe this approach is incredibly flawed. Firstly for those unfamiliar with the accounting, the value of the liability is determined by discounting the expected rent payments by the company’s incremental borrowing costs at the time of signing the agreement (the current weighted average is 8.1%). This means that if the company had an average lease term of say 5 years, instead of the current 32 years, the liability would be much lower. This begs the question would the business be more valuable if the leases terminated after 5 years? I believe the answer is no unless the leases cause the properties to become free cashflow negative.

It is worth dedicating some time to how the rent payments are determined though as it is a significant expense. Typically the rental agreements specify an initial rent amount that is revised upward with the CPI. There is also sometimes a fixed component. Often, after a few years, the rent payments are also partially adjusted to reflect changes in revenues at the underlying properties. Rent is lowered if revenues drop and raised if revenues rise. There are also usually rules about how much must be spent on capex as well as certain ratios being maintained for the properties included in the agreement (usually rent to EBITDA or rent to revenue). These covenants are not included in the initial leases that Caesars signed when the REIT was formed but in since deals they have been included. If Caesars is not in compliance with these covenants then the operating subsidiaries for the casinos covered by the agreement can be restricted from paying dividends to the parent.

Properties

In addition to the properties rented to Caesars they own a substantial amount of the real estate they operate on as well. Management has indicated that some of these properties can be sold to reduce leverage and in some cases, it will have no impact on FCF. Tom Reeg said the following when asked if there were any opportunities to de-lever

We have a number of assets that produce very little or no cash flow that are noncore to the business, non-operating casinos that could potentially be monetized at attractive rates where you wouldn't have to change your model much. And without getting too forward-looking, you shouldn't be surprised if some of those types of things start to happen in 2024 that our leverage reduction is not limited to only free cash flow.

Since these comments management has divested WSOP to an iGaming developer for $500M while still maintaining certain rights in relation to the brand. Given that the company will hardly see earnings lowered at all from this transaction it will reduce leverage by a fair amount. There are also assets like a vacant plot of land on the strip and a real estate development surrounding the Pompano Casino that could easily be monetized for over $600M.

The following are the properties with Real Estate owned by Caesars

Debt

CZR’s debt load is fairly substantial with a pretty even mix of floating and fixed debt at a variety of different maturities. At this point having some floating debt is fairly positive as interest payments will fall with rate cuts. Each 25bps cut will save the company around $15M in interest payments a year, which is pretty substantial.

Operating Businesses

Regionals

The company’s regional division is responsible for around 45% of total EBITDA and properties span many states. As mentioned above there are nice synergies between the regional, Vegas, and increasingly interactive businesses as the rewards program status that regional players have often makes Caesars’ Vegas casinos more attractive than competitors. There are some concerns about online sports betting and iGaming eating into regional casino profits. This analysis found that iGaming legalization increases revenues at land-based casinos. Caesars commentary has echoed this with Reeg saying the following in response to an analyst question

If you look at the businesses, we want to emulate in the iGaming arena, they look like our brick-and-mortar business in terms of skewing to slots and older and female. And since we've launched Caesars Palace Online, that's exactly what we've seen in that app. So very encouraging. In terms of early days results. In terms of cannibalization, we have seen nothing to date in terms of cannibalizing the brick-and-mortar business. It's been accretive to brick-and-mortar in that -- customers that we found through digital or reactivated in digital, showing up in brick-and-mortar continues to increase as the quarters pass. So very pleased with how that business is developing.

The lack of cannibalization makes sense as many people live quite far from a casino despite living in states where gambling is legalized, and also on the sports betting front it is much more convenient to do it online. It is nice to hear that the online business is funneling online first customers into the physical casinos and the brick-and-mortar customers are likely to choose Caesars online offerings over the competitors.

In this segment, the largest public competitors to Caesars are Boyd, Penn, and Bally’s so it can also be useful to review these companies’ results to get a feel for general trends.

The other thing to mention is that in conjunction with the merger Caesars assumed projects in both Danville, Virginia, and Columbus, Nebraska, and was also required to make a large $400m investment in Atlantic City at their existing properties. Looking forward Virginia will be complete this year and Atlantic City and Columbus will be wrapped up. It can be a bit difficult to find the true maintenance capex as room upgrades fall into the same bucket as growth. This is a bit aggressive as even though renovations usually boost ADRs the rates would fall if the rooms got too dated so the spend is a combination of maintenance and growth in my opinion.

I would assess this segment as being of fairly high quality given that the regulatory environment in many of the states makes it difficult for new competing casinos to open. It generates around the same EBITDA as Vegas with a lot less assets on the balance sheet but it is lower margin. The other negative is that markets come under competitive pressure when new casinos open. Sometimes customers had been driving 2 or 3 hours to come to the Caesars casinos so when another casino opens closer to them that customer is lost. Also, the new casinos usually offer aggressive promotions which can attract customers a more even distance between the two casinos to the new competitor. I would be willing to pay a higher multiple for this regional business than I would for the average consumer discretionary company as the regionals are less cyclical, have higher margins, and have a better moat than most other companies in the discretionary sector.

Vegas

The Vegas segment is an incredible asset that is in a very strong position. Over the past few years, Vegas has done a lot to establish itself as not just a gambling destination but also as one of the best tourist destinations in the US with passengers arriving at Harry Reid increasing from 51.5M in 2019 to 57.6M in 2023. People tend to continue to visit Vegas in economic downturns it is just the visitors spend a lot less on gambling, food, and drink.

Most of Caesars portfolio would fit into the low - low-mid tier with the exception of Caesars Palace and The Cromwell which would be mid-tier or even upper-mid. As mentioned above Caesars benefits from its vast regional presence by ensuring that these people stay at one of the Caesars properties when they do visit Vegas and although Caesars Palace is mid-tier they do offer very high-end suites that are attractive enough to bring High Rollers in.

The segment generates around half of the company’s EBITDA however the capex requirements are lower for this segment. Unlike the regional segment revenues are not that gambling dominated with gaming revenue being under a third of the total and the rest coming from hotels, food, and others which includes revenues from shows and retail space rentals. Looking at the gaming piece Vegas is a lot more table game heavy while regionals have a higher percentage of slot play. This makes Vegas gaming revenues more volatile as hold can come in low or high every once in a while. The fact that real estate on the strip is mostly already occupied means the properties have a much stronger moat than any one of the individual regional casinos. Hotel rooms on the strip have decreased recently despite the strong demand as the Tropicana is being demolished to make room for an MLB stadium and the Mirage is being closed so that it can be demolished to build a Hard Rock Resort. I would assess this segment as being of higher quality than the regionals thanks to the better moat, and higher margins.

The Digital Business

In addition to the unreplicable assets on the strip Caesars also owns a very intriguing digital business with both sports betting and iGaming offerings.

Recently the digital division has gone from losing substantial amounts of money to being a substantial EBITDA contributor. Additionally, the EBITDA will improve once some poorly priced sponsorship deals signed by the previous Caesars management team start to roll off. The Caesars team has also shown a lot of prudence in managing spend on advertising and has been more conservative in only going after customers with higher LTVs. For those who don’t know, many sports betting companies offer generous introductory offers giving away free bets or offering to comp losses if the first bet loses. Recently they have improved their marking system and they are now targeting offers only to customers in their database that they believe will be profitable which should provide a nice boost. In addition, the Digital team has also expanded same-game parlay offerings which will increase hold. They even bought an Australian company ZeroFlucks that will help them price parlays better. A parlay is a bet on multiple outcomes occurring, often in the same game. This is more attractive to gamblers as it increases the maximum payout. In addition, Caesars has launched a Caesars Palace iGaming platform that should help on the marketing front and they are launching a horseshoe-branded casino that should have a positive impact as well.

Growth in this segment has been very strong and volumes in the states where iGaming and OSB are legal should continue to grow in addition to new states coming online. Caesars has managed to improve hold (percent of the amount wagered held) by introducing and promoting parlays as well as pricing bets better. This segment can also experience some volatility as for large events like March Madness, the Super Bowl, or NBA finals the outcomes might be unfavorable.

In this segment, the primary competitors are FanDual, Draftkings, MGM, Wynn, and Penn. While the segment has posted very strong growth there is some regulatory risk as a lot of people, particularly young guys become gambling addicts. Although states are not particularly incentivized to crack down on gambling, as they receive a lot of revenue from it, it is possible that in the future limits could be placed on what kind of marketing is permitted or taxes could be increased. Studies have found that states that legalized gambling see a decrease in investing account contributions and an increase in bankruptcies. Even still, gambling is likely a more optimal revenue source for politicians than other methods like tax increases so the companies should be reasonably well protected.

Due to the high growth the sector is experiencing stand-alone companies tend to trade at very high multiples. DraftKings, for example, is trading at 4x ttm revenue. If you value Caesars digital revenue on the same basis it would be worth over $4.3B and unlike DraftKings, Caesars is profitable on an Ebitda basis while DraftKings put up a considerable EBITDA loss ($550M if you add back SBC expense). Management believes that towards the end of next year digital should be contributing $500M in EBITDA saying the following.

If we look at it in a different way, in terms of what I see as I look at how we build this business, we did $1 billion of net revenue in digital in 2023. We reported $40 million of EBITDA on a hold adjusted basis fourth quarter, that’d be $60 million, whether you use $40 million or $60 million, start there. The industry is growing at 30% this year. We’re growing. We should be growing at least at that given our iGaming is growing considerably faster than the market. As Eric said, our flow through was in excess of 50% in this quarter. So if you take the billion, you have us grow at the market level and you flow that through, it’s very easy for you to do that math. If you do that again in 2025, that should get you to something like $1.7 billion of revenue and something over $400 million in EBITDA. That does not include any benefit from the partnerships that roll off in the 2024, 2025 time frame. That’s how I get to the $500 million target in 2025 that very few of you believe that I see as really simple math and continuation of what’s already happening in this business. If you want to quibble with me whether $500 million is a full year 2025 number or we’re run rating at that level in 2025 and don’t quite get to $500 million I’m happy to have that discussion.

Given that there won’t be too much SBC it seems like $4.3B is actually far too low of a valuation for the digital segment. The other thing to consider when assessing the results is that marketing spending is all expensed in the quarter that it occurs in when in reality it benefits the company over a longer period so this can make results pretty lumpy.

Valuation

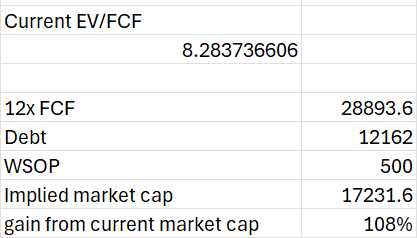

I think the best way to value the business is first to come up with what the normalized earnings for the business are. I prefer to use Adjusted Ebitda - SBC -maintenance capex. For maintenance capex, I am going to allocate some of the growth capex to this amount to be conservative, since as I touched on above I think some of the growth investments are necessary to maintain earnings. Then there is also the matter of considering what multiple the company should trade at. Assuming the forward eps estimate from Invesco is roughly accurate the median consumer discretionary company in the S&P 500 is trading at just under 16 times earnings. Caesars is more highly leveraged which realistically will weigh on the multiple that it can achieve and overall I view it to be of comparable or slightly better quality than the other companies taking into account cyclicality, moat, growth, and capital allocation skills of management. The FCF number I came up with is also pre-tax while the net income multiple for the sector is calculated on a post-tax basis. As a result, I think the FCF multiple should be at least 12x.

To be conservative I will take the 2023 numbers as the run rate EBITDA for both the regional and Vegas segments. This is not taking into account the new Danville or Columbus facilities but some of the regionals have come under competitive pressure so this estimate is playing it safe. In Vegas last year’s EBITDA number should be fair, Then for digital, I am assuming that management’s $500M estimate is correct. I am assuming the corporate segment loss stays flat. On the Capex front, I am also being conservative and assuming that maintenance run rates at the 24 number, 30% of growth capex is required to keep earnings the same at properties, and digital capex stays at the 24 estimate although I could see this surprising to the downside once all the states are online, and all the platforms are launched. Lease interest payments are being recorded at the 2023 rate as the finance obligation always accrues interest at the same rate although it will rise with inflation.

Then on the Enterprise value front, I have debt at face value, and the WSOP amount of $500M counted as cash even though some of the consideration is to be paid at a later date.

This means that the company is trading at just 8.15x forward free cashflow making the stock an incredible bargain. I think overall this is a conservative valuation as it does not consider the other non-core assets likely to be sold by the end of the year. Also, the digital segment should continue to grow even after it hits the 500M Ebitda mark so overall you can tell that this stock is very low risk at the current valuation. If the company did hit the 12x FCF multiple I mentioned above that would represent a 108% gain for the stock putting it at just under $80 per share.

Hopefully, this write-up was a good read and I would be happy to write a piece comparing Caesars to some of the other companies in the gaming space if there is interest.