Gray Television-GTN The company no one wants to own. Are they right?

How Gray can generate a market beating return even if it sees heavy multiple compression

Many of the greatest investments have been contrarian. Conversely, many public companies have found themselves to be in decline, gone bankrupt, and their stockholders have watched their holdings go to zero. In this piece I will explain the business of Gray television and try to predict which fate its investors will meet. So far the stock has fallen ~44% this year and ~70% over the past 5 years.

The Business

Although running TV channels seems like a straightforward business it turns out to be a little more complex. Firstly each TV channel in the US is assigned to a DMA or designated market area. There are limits to how many channels in a given DMA one company can control. There are 210 DMAs and Gray operates in 113. Of these 113 jurisdictions Gray’s channels had the largest ranking in 79.

In addition to revenue generated from selling advertisements Gray also makes money by selling the rights to broadcast their feed to cable providers, satellite providers and MVPDs (Multichannel Video Programming Distributors) which include legacy services like Xfinity, DirecTV and Dish and newer Virtual MVPDs like Hulu, YouTube TV, Sling TV, and Fubo. This is referred to as retransmission revenue. For each 3 year cycle each channel must choose between being a consent channel or a must carry channel. Being a consent channel means all cable systems serving the area need to negotiate with Gray if they want to run the channel while a must carry channel must be carried by all systems serving the area. The current agreements expire in 2026 and the fees received by Gray are a function of how many subscribers the distributors have.

Gray splits their advertising revenues into core and political although they used to break core into national and local. Core revenues tend to be lower in election years as the political ads eat into air time that otherwise would have gone to core ads.

On the cost side one of the most substantial costs to Gray is their affiliation agreements with FOX, NBC, ABC and CBS the ‘Big 4’ networks. The programming on most of Gray’s channels are a combination of their locally produced programs like the news and increasingly sports, national programs from one of the Big 4 networks like National news, Sitcoms, and Sporting events, and also other programming the network may have bought like Wheel of Fortune or Seinfeld re-runs. The commitments for 2024 under the affiliate agreements are just over $1B. The Big 4 also receive the rights to most of the ad time during the broadcasts of their programs.

There is somewhat of a risk to Gray under the current model as the retransmission revenue they receive is tied to subscribers while their affiliate fees are fixed amounts. This means that should retransmission revenue decline Gray’s margins will become depressed.

There seems to be a popular misconception among investors that companies like Gray are irrelevant middlemen but this is quite far from the case. The shows on Gray’s channels that receive the highest ratings are actually the shows produced by Gray like the local news.

Sports rights situation

The company’s stock has fallen a lot so far this year, partially due to the debt situation, which I will cover later, but mostly due to news regarding a sports joint venture between WBD, ESPN, and FOX. The broader context behind this is that a lot of the broadcasters entered into onerous contracts with sports leagues back when there were more cable subscribers and they were willing to pay extra for ESPN, Fox sports, and TNT. The JV will be a virtual MVNO, essentially there will be one subscription in which the subscriber can watch TNT (owned by WBD),ESPN and Fox Sports. The parties are not allowed to collude on bidding, as this would violate anti-trust law.

Essentially the view is this is bad for Gray because the JV partners will be empowered to bid more than the Big 4 (ex fox) since they will forecast more revenue as a result of the JV. The worry is this will lead to less viewers for Gray and therefore less retrans and ad revenue. While the JV news is slightly negative, if the Big 4 lose some sports Gray should be able to negotiate lower affiliate fees as a result of this. In reality the broader situation with sports rights is, if anything, a positive for Gray. Basically prior to today if you wanted to watch your local teams games you had to buy a Regional sports network(RSN) package which were mostly owned by Sinclair’s Diamond Sports group (DSG) or by WBD RSNs. Both companies have sent their RSNs into bankruptcy because they were losing money. Effectively the leagues signs contract(s) for national rights but a team is able to sell the rights to watch their team in the local market. The RSN model no longer works so Diamond is looking at making one master RSN service in which you can stream all their RSNs for one subscription. Diamond has not executed well, team are starting to get fed up and fear that Diamond will just be back trying to renegotiate again if their subscriber numbers are weak. As a result Gray was recently able to outbid DSG for the rights to stream Phoenix Sun’s games. They have also managed to secure game packages with the NBA’s Hawks, Cavs, Mavs ,Pelicans and Bucks. Most of diamonds contracts with MVPDs provide increases in retrans fees if new programming like sports is added and it is possible that having more sports coverage could lead to an increase in vMVPD subscriptions or slow the decline rate in traditional MVPD subscribers.

Management and Governance

The Company’s CEO and Chairman is Hilton Howell Jr who has been in his role since 2008. Very weirdly he is also the President and CEO of an insurance company, Atlantic American Corporation, with a market cap of under $40M, which he has done since 1995, he also still holds the role of Executive Vice President and General Counsel at Delta Life Insurance Company. If you are wondering why the board lets him do this it is probably because the company is majority owned by his wife’s family.

There is also a Co-CEO and president Donald P. (“Pat”) LaPlatney who has been in his role since 2019 when Raycom, where he worked, was acquired by Gray. He had been CEO there since 2016 and worked there since 2007. In the proxy statement Hilton Howell is listed as the CEO while Pat is listed as Co-CEO. The fact that one of them has to put Co in front of his name while the other doesn’t kind of gives me the impression that Hilton is calling most of the shots. Prior to Pat joining the company there was no Co-CEO.

The other strange thing in terms of governance is that a member of the compensation committee, Paul McTear, was CEO of Raycom right before Pat was, until he retired. Since they worked side-by-side for years it seems strange for him to be involved in determining compensation.

The company has both Common shares and Class A shares with the Class A shares each having 10 votes. There are around 90M common shares and 9M Class As. Basically all the class As are owned by Hilton, his wife, his mother in law, and the Insurance company he is CEO of, so it is safe to say that they basically control the company.

In terms of compensation the structure is also not great. There is the base salary, an annual cash payout, and long term incentives. The annual cash payout is targeted at 150% of salary for Hilton and 100% for the rest of the NEOs. 15% is determined by non-political Broadcast Revenue, 15% by political broadcast revenue and 30% by broadcast cash flow. The other 40% is based on qualitative measures which are disclosed but it is pretty unclear how performance is actually measured. Hilton got 190% of the amount out of a possible 200% on the qualitative measures for 2023 even though he missed the target performance number on 2 of the 3 quantitative measures. The long term incentive is targeted at 400% of base salary for Hilton and 200% for the rest. It is meant to be 50% time and 50% performance, however the performance is based on the cash incentive amount for each of the 3 years instead of stock price so it is a pretty bad deal for shareholders given how the cash incentive amounts are dubious.

Overall, Hilton made around $4.8M in cash compensation plus his RSUs that had a fair value of $5.8M. Pat got around $3m in cash and around $2.5m in RSUs.

Financials and Outlook

The companies earnings are highly cyclical with presidential election years being the best, followed by midterm years with non-election years being the worst. As a result 2024 should be a very good year although slightly weakened by the fact that neither party is having a serious primary. The companies PF(pro forma) Q1 revenue was slightly weaker than it was in 2020 as a result of this. Despite this Gray expects PFQ2 revenue to be 55-72% higher than it was in the same quarter of 2020. Gray has a strong presence in 6 of 7 of the main swing states ad of states with gubernatorial races it has the top news show in 9/11 and in states with senate races the top news show in 26/34. There are also the house seats being voted on and certain states have contentious referendums on the ballot. Additionally Gray completed construction on their assembly studio project. The project was definitely a poor decision given where Gray’s borrowing costs currently are, however, it was started at an awkward time so I see how management viewed it as a sunk cost.

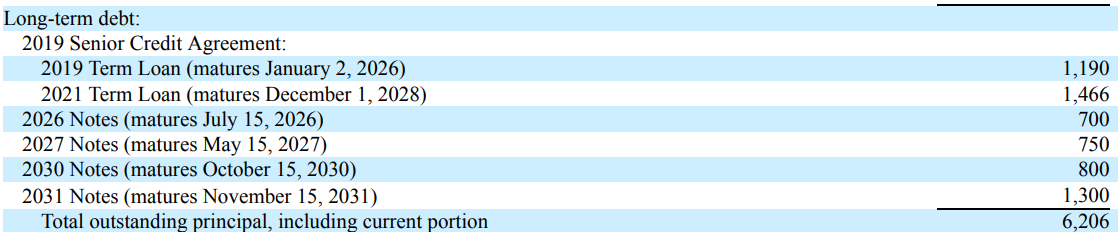

Now moving on to debt. As of the end of Q1 the company had $6,139m with the following maturities.

Given how highly leveraged it is the company decided to be prudent and refinance their 2026 term loan and notes in the second quarter. They recently completed this refinancing and it caused the stock to fall as rates were higher than expected. The 2026 notes bore interest at a rate of 5.875% while the new notes pay 10.5% and mature in 2029. Originally there was meant to be $750M in notes and a $750M term loan but the company ended up doing $1250M in notes and $500 on the term loan which bears interest at S + 525. Both the term loan and the Notes mature in 2029.

Valuation

Gray is a very difficult company to value for a few reasons. There is the cyclicality, inconsistent decline rates and the fact that a lot of FCF has been used to acquire additional stations with over $6b being spent since 2019.

Given the high debt level and predictable capex the best valuation method is to take FCF/EV with the debt being accounted for at principal value and the FCF being the average pro forma adjusted ebitda from the past 4 years with a few tweaks minus the 2024 estimated capex excluding the Atlanta project as this seems like a fair run rate. I also choose to count SBC as a real expense. Fortunately Gray provided pro forma numbers for 2020 and 2021 to adjust for the 2021 transactions. They only disclosed revenue and net income, however I will assume just take the Ebitda margin from the non-pro forma results and assume it held flat. This is a conservative assumption as there are synergies that would cause the ebitda margin to increase. The capex number being used will be the high point of their 2024 guide minus investment in assembly Atlanta as this quarter is the last of that construction. This gives an expected FCF yield of 14.4% over the next 4 year cycle. Additionally Gray will benefit from rental revenue generated from their new studio space that has been being built since 2021. On top of this FCF can be deployed at a high rate of return by buying back debt at a discount to face value. Some 2029 notes are trading around $0.50 on the dollar although there are limits in some of the credit agreements for more senior debt limiting how much can be spend on shareholder returns and more junior debt repurchases. Also around 42% of the debt bears interest at floating rates so interest expense should fall substantially once the fed cuts. This is substantial as a 100bps of cuts would decrease the interest expense by ~34M, a pretty substantial sum for a company with a market cap of just over ~500M.

Despite the strong cash flows expected Gray will not necessarily be a great investment overall. Realistically if you are going to exit the stock in say 4 or 5 years it is conceivable that you could be exiting at a lower multiple than today’s. Previously the stock has been called a value trap and at over $10 a share I believe that it was. It is sometimes the case that businesses that are viewed as in decline see multiples continually compress even if earnings remain strong. In many ways Gray reminds me of British American Tobacco. Both companies have a core business that is under a some pressure (cigarettes for BTI and traditional MVPDs for Gray) and a new generation of products that the markets doubts can fully replace the business in decline ( Vapour, heated tobacco, and nicotine pouches for BTI, vMVPDs, and FAST for Gray). However at a 14% FCF yield (7x FCF) even if you had to sell at an exit multiple of 4.5x FCF (22.2% yield) you would still have made an 8% IRR over your holding period. I think the current multiple is so low that even with the potential for further multiple compression things should work out. As a result I am long with a starter position.